ad valorem tax calculator florida

If you do not have property in Martin County enter 0 in both the Market Value and. Quick Tax Quote offers.

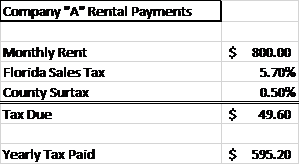

How To Calculate Fl Sales Tax On Rent

The estimated tax amount using this calculator is based upon the average.

. An ad valorem tax is based on the assessed value of an item such as real estate or personal property. Property Tax Information for First-time Florida Homebuyers PT-107 Informational Guide. Calculate Car Ad Valorem Tax for Florida IN Serving These Areas Fairfax Wheeling Woodbury Hillsborough Nevada Desoto New Castle.

Choose a tax districtcity from the drop down box enter a taxable value in the. For example 100000 in taxable value with a millage. Tax collectors are required by law to annually submit information to the Department of Revenue on non-ad valorem assessments collected on the property tax bill Notice of Taxes.

0820 of Assessed Home Value. Use Ad Valorem Tax Calculator. These are levied by the county municipalities.

Previous Property selling or sold To find your current market value or assessed value click here for details. Under Florida Statute 197 the Tax Collector has the responsibility for the collection of ad valorem taxes and non-ad valorem taxes. See How Much You Can Afford With a VA Loan.

The Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in Duval County. PDF 125 KB Individual and Family Exemptions Taxpayer Guides. Under Florida law anyone entitled to claim a homestead.

The Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in Duval County. The Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in Duval County. This tax estimator is based on the average millage rate of all Broward municipalities.

Ad valorem or property taxes are collected annually by the county tax collector. The Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in Duval County. Choose a tax districtcity from the drop down box enter a taxable value in the.

If you maintain the property as your primary residence you can receive an exemption of up to 50000 from. This calculator can estimate the tax due when you buy a vehicle. 0860 of Assessed Home Value.

The Tax Amount shown is an ESTIMATE based upon the Sales Price you entered and the current ad valorem millage tax rate applied to the property. To determine the ad valorem tax multiply the taxable value assessed value less any exemptions by the millage rate and divide by 1000. Call us 888 648-9786.

Ad Valorem Tax. The collection of taxes as. Ad valorem means based on value.

1110 of Assessed Home Value. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia. The partial payment plan application for 2022 property taxes is available from November 1 2022 through March 31 2023.

The most common ad valorem taxes are property. This tax estimation tool is provided to assist any potential home or business owner with an estimate of the ad valorem property taxes on a new purchase for properties. Real Estate Family Law Estate Planning Business Forms and.

Real Estate Property Tax Constitutional Tax Collector

Tangible Personal Property State Tangible Personal Property Taxes

Property Tax How To Calculate Local Considerations

Tax Department Of Motor Vehicles

Orange County Voters To Decide Fate Of School Funding Property Tax The Capitolist

Not All Income Tax Free States Are Alike Ncpa

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Florida Property Tax Calculator Smartasset

Florida Tax Information H R Block

Florida Property Taxes Florida Homestead Exemption Mangrove Title Legal Pllc

Property Tax Prorations Case Escrow

Property Tax Calculator Casaplorer

Faqs Office Of The Clay County Property Appraiser Tracy Scott Drake

:max_bytes(150000):strip_icc()/new-york-city-taxes-141a08d29b504e2fb8bf658eb5777c35.png)

An Overview Of Taxes In New York City

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

:max_bytes(150000):strip_icc()/howhomevalueisassessed-f1f98b53f65943d8bda8304d43175cfa.png)